For many major consumer banks in the United States, first impressions are critical: whether customers have a positive or negative experience opening their account can set the emotional tone for all future interactions with the brand.

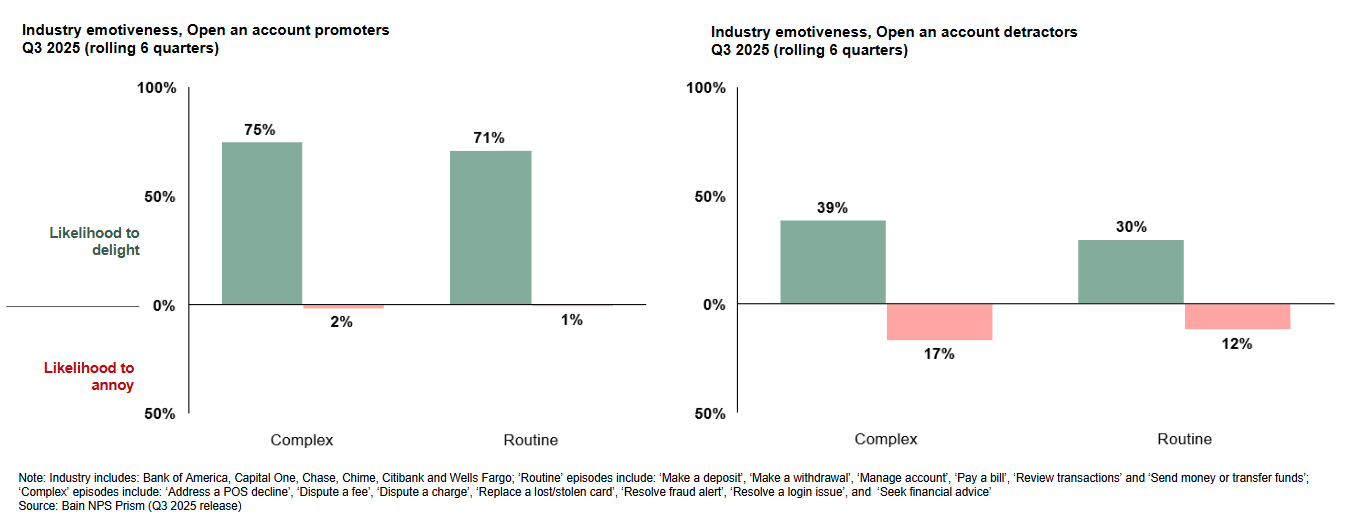

Q3 2025 NPS Prism data on several players across the industry reveals that when customers complete the account-opening experience as a Promoter, meaning they have a higher Net Promoter Score (NPS) and are likely to recommend the bank to a friend, their future interactions with their bank are much more likely to delight rather than annoy them.

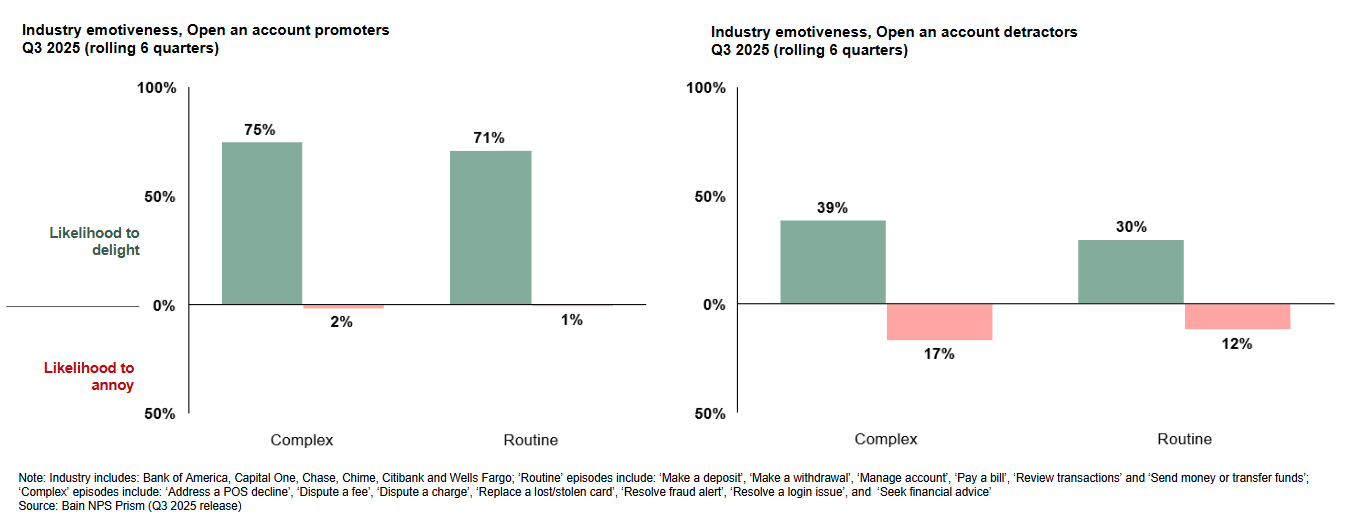

However, when customers have a negative, or Detractor-creating, experience opening an account, later interactions are more likely to annoy and less likely to delight them than Promoters.

This finding holds true across both routine episodes, like making a deposit, paying a bill, or reviewing transactions, and complex episodes like disputing a fee or resolving a fraud alert. For Promoters of the account-opening experience, all journeys boasted very low average likelihood to annoy (1%) and high average likelihood to delight (68% - 74%), regardless of their complexity.

When looking at the same routine episodes, Detractors are 21 percentage points more likely than Promoters to be annoyed by their experiences and 41 percentage points less likely to be delighted by them. Complex episodes are the least likely to delight Detractors, scoring 50 percentage points lower in this category than Promoters.

Prism data also shows that easy, streamlined processes are particularly important to customers during the account-open experience.

When customers don’t describe their account-opening experience as “perfectly easy” or they report problems setting up online banking access, a 40-point and 20-point NPS penalty is incurred, respectively.

A 30-point NPS penalty is also incurred when it takes customers more than one try to open a new account. With fraud increasing in the US, more stringent verification requirements mean the industry has seen the percentage of customers who can open an account in one try decrease.

These findings underscore how crucial the quality of that early account-open experience can be to the longer-term relationship between bank and customer, and that banks who prioritize efficiency and ease in the journey cultivate trust and advocacy that extends to many future touchpoints.

Get more insights on critical customer journeys that drive loyalty

Schedule a personalized discovery session to explore our platform and gain never-before-seen NPS insights based on thousands of banking customers, with competitive analyses curated to give you insights on your episode performance and key drivers of customer loyalty.