October 30, 2025

6 minute read

Want a detailed look at how your CX stacks up against competitors? Request a demo today.

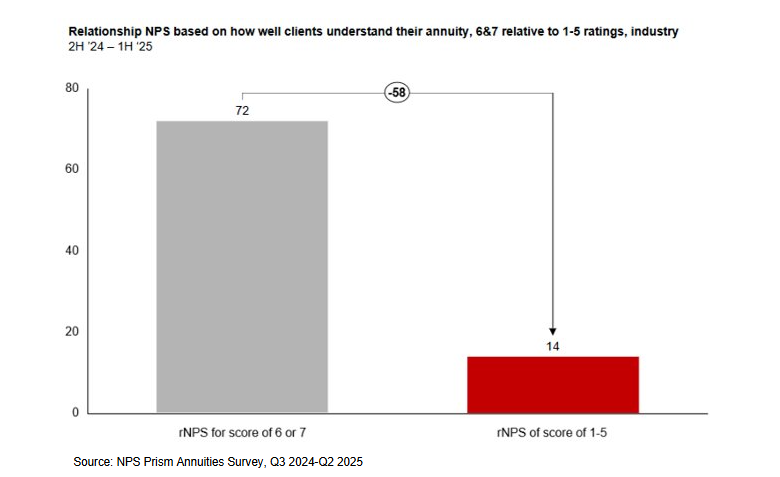

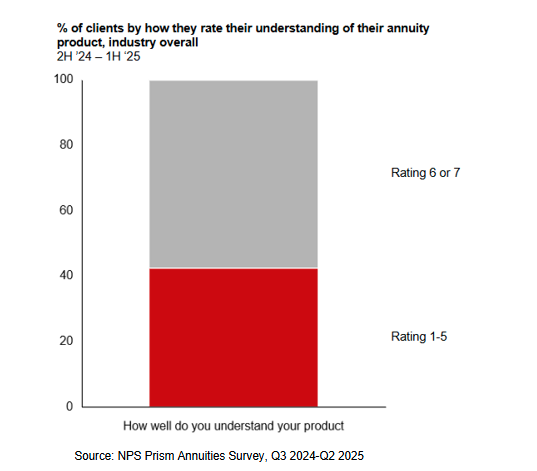

Less than half of annuities clients understand their product, significantly impacting brand-level NPSNearly 40% of annuities clients signal that they do not fully understand their annuity product—a factor that NPS Prism data shows is a critical driver of brand-level NPS. When clients rate their understanding as falling between a 1 to 5 on a scale of 7, as opposed to a 6 or 7, providers face an average NPS penalty of 58 points, indicating that providers should ensure clients have a thorough understanding of their annuity product to drive overall satisfaction.

Product understanding decreases among complex products, longer tenured clients

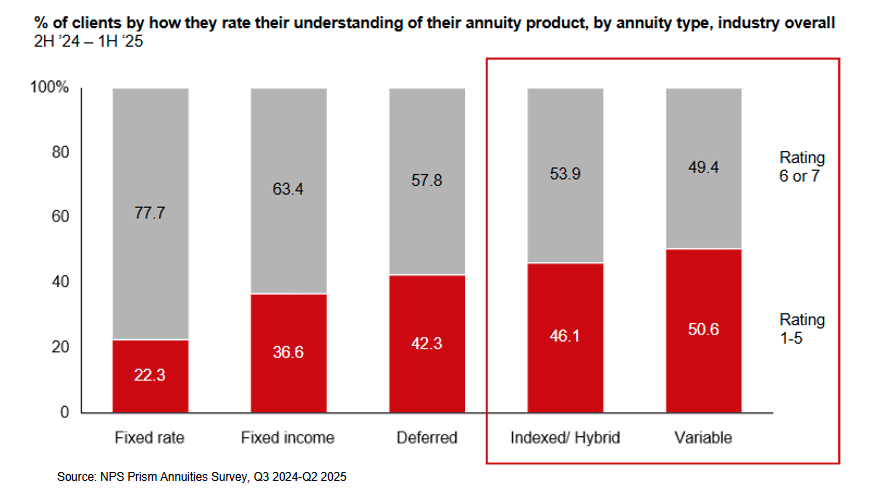

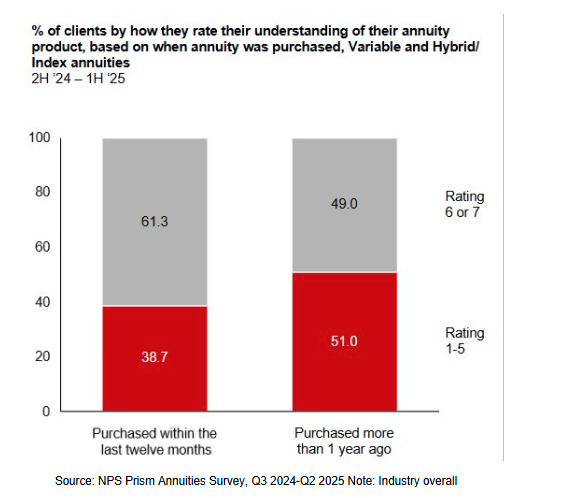

Particular attention should be paid to clients with more complex annuity products, like variable & hybrid/indexed options, especially those who purchased their products more than a year ago.

Around 50% of clients with a variable annuity have limited understanding of the policy, while only about 20% of clients with a fixed rate annuity feel that way. Ratings between 1-5 (lower understanding of product) increase by ~12% for variable and hybrid/indexed products purchased over a year prior, suggesting that clients may be less clear on the details of their policy the further out they are from the purchase process.

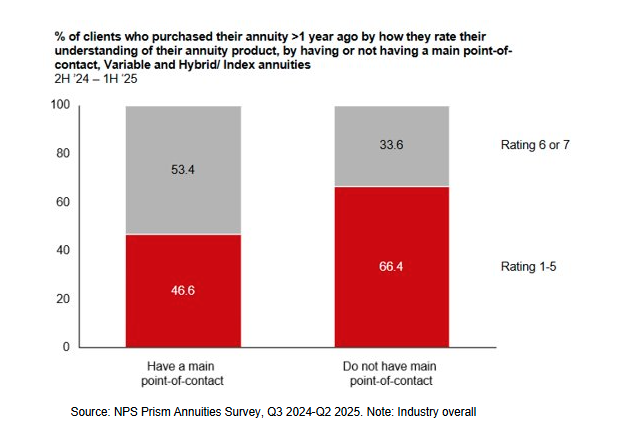

Having a point-of-contact at the firm helps strengthen product understanding as client tenure increases

Establishing a clear point-of-contact is a step providers can take to ensure that clients continue to maintain a strong understanding of their annuity product throughout their relationship with the company.

Out of clients who purchased their product over a year ago, those who feel they have a main point-of-contact see a 20-percentage point increase in strong product understanding ratings (6 and 7), compared to clients with no main point-of-contact.

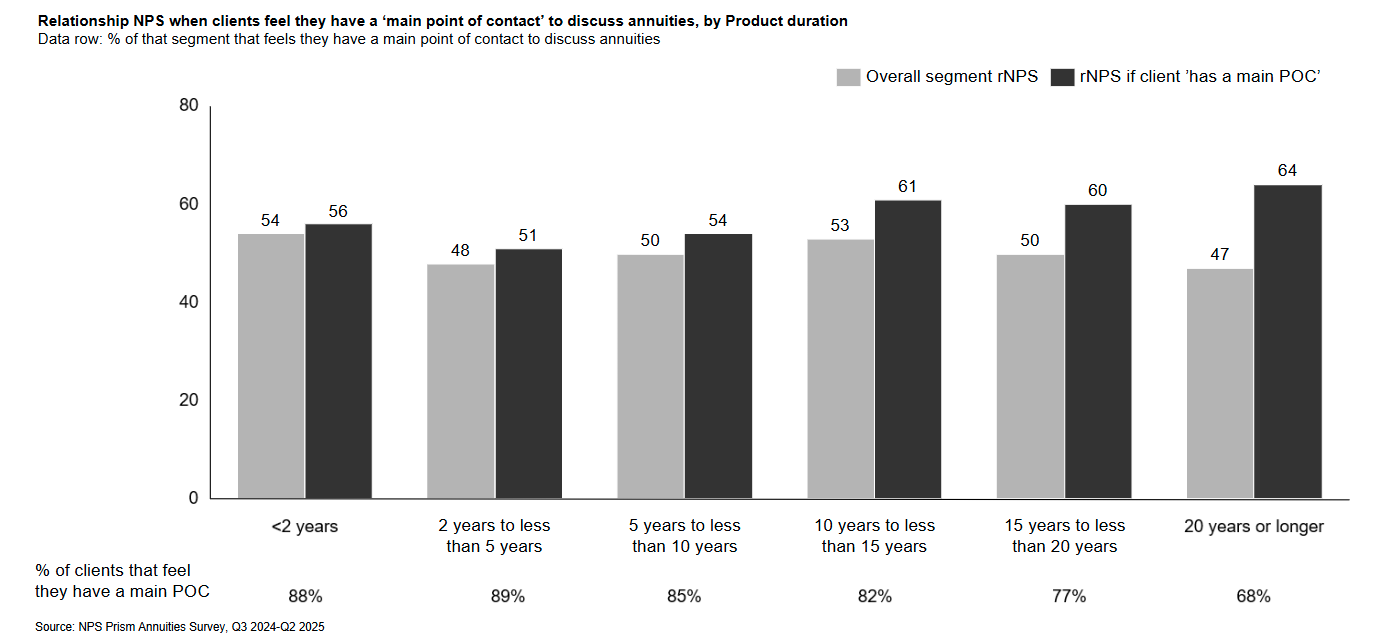

Having a main point-of-contact also strengthens overall brand-level NPS as client tenure increases. The difference between average NPS for all annuities clients and those who feel they have a main point-of-contact goes from 2 points to 17 points over the product duration timeline.

Prism data shows that this remains an area of opportunity for annuity providers. As product duration grows, clients are less likely to perceive they have a main point-of-contact at the company, despite its increasing impact on NPS performance. The percentage of clients who feel they have a primary contact drops by 20 percentage points from a <2-year to 20+ year product duration.

By ensuring clients have a strong relationship with their point-of-contact throughout their tenure, through more regular touchpoints or better communication around how to reach them, annuities providers can ensure clients continue to understand the details of their product long after the purchase process, driving stronger brand advocacy as a result.

Discover even more opportunities to drive annuities satisfaction

Schedule a personalized discovery session to explore our platform and gain never-before-seen NPS insights based on thousands of annuities clients, with competitive analyses curated just for your business.

Subscribe to our blog to learn about all the major industry trends revealed by NPS Prism data.