Want a detailed look at how your CX stacks up against competitors? Request a demo today.

Vulnerability in the UK is widespread and multidimensional – over 50% of UK customers identify as vulnerable (“especially susceptible to harm” based on factors including health challenges and major life events*), and many face overlapping challenges. Within the UK banking sector, this population is represented across a variety of products and income levels, with over half of UK customers who identify as vulnerable holding multiple products with their financial institutions.

So how can UK banks better serve this critical segment? Recent NPS Prism data from 1H 2025 pinpoints key elements to prioritize to strengthen trust and streamline the banking experience for vulnerable customers.

Which factors matter most to vulnerable banking customers?

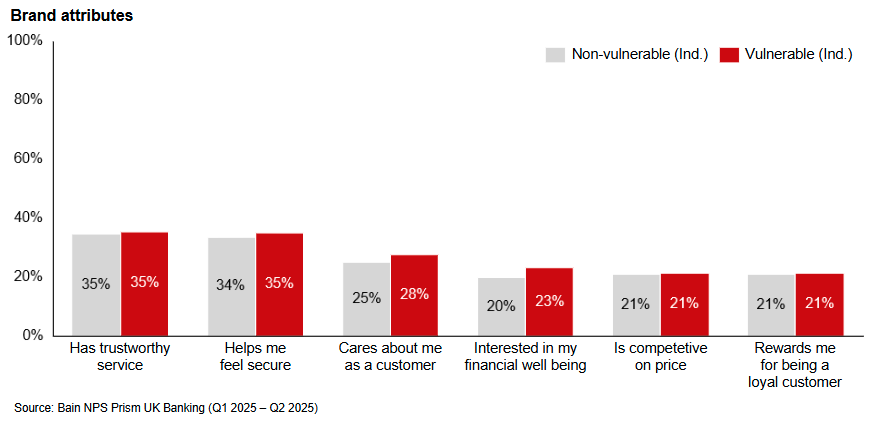

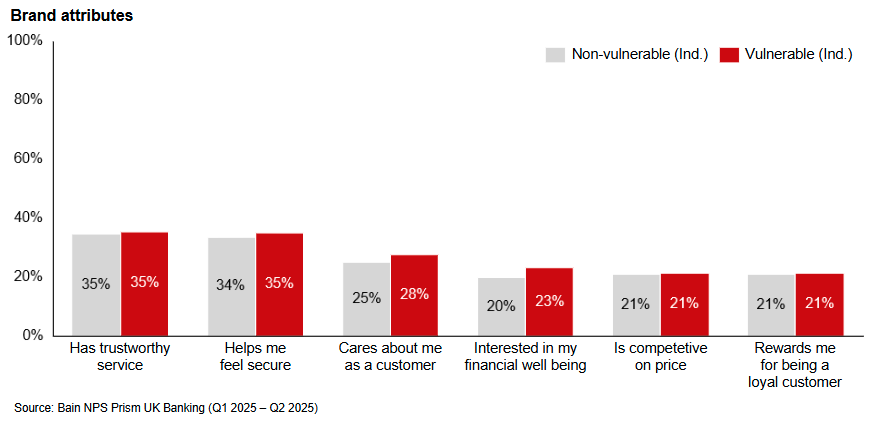

NPS Prism findings reveal that vulnerable customers report comparable and sometimes slightly higher levels of trust towards their bank. When asked about key brand attributes, they are nearly equally likely to feel an institution has trustworthy service and helps them feel secure, and slightly more likely to believe they are cared about as a customer and that their bank is interested in their financial wellbeing.

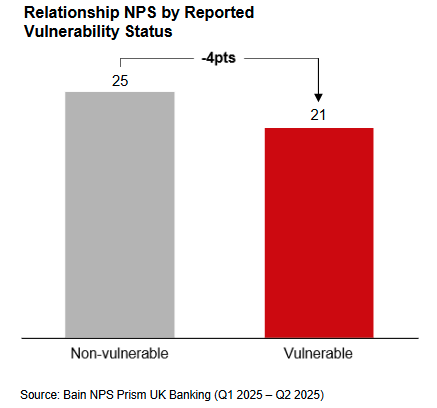

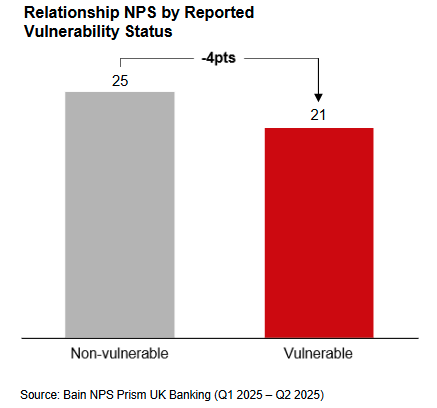

However, this population is still less likely to recommend their bank to friends or family compared to their non-vulnerable peers. Comparable perceptions around these attributes suggest that lower brand-level NPS among vulnerable customers is more likely due to gaps in their everyday experience, as opposed to customers feeling less protected and valued by the brand.

Day-to-day interactions are more difficult, time consuming, and costly for vulnerable customers.

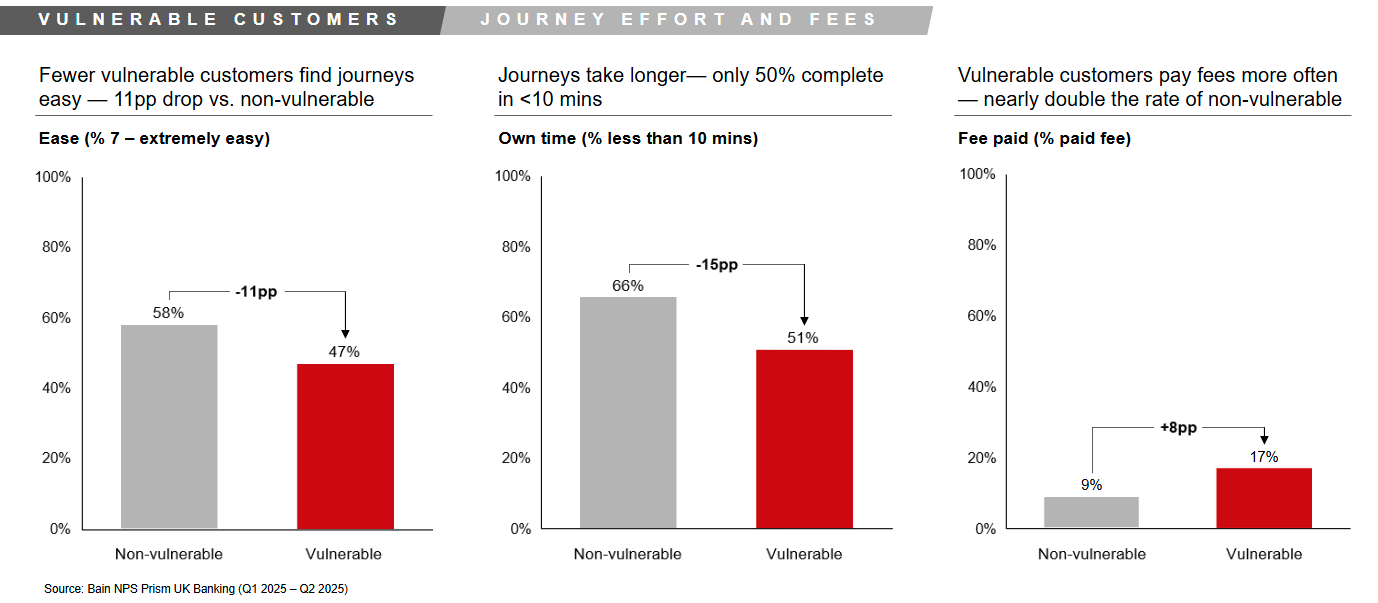

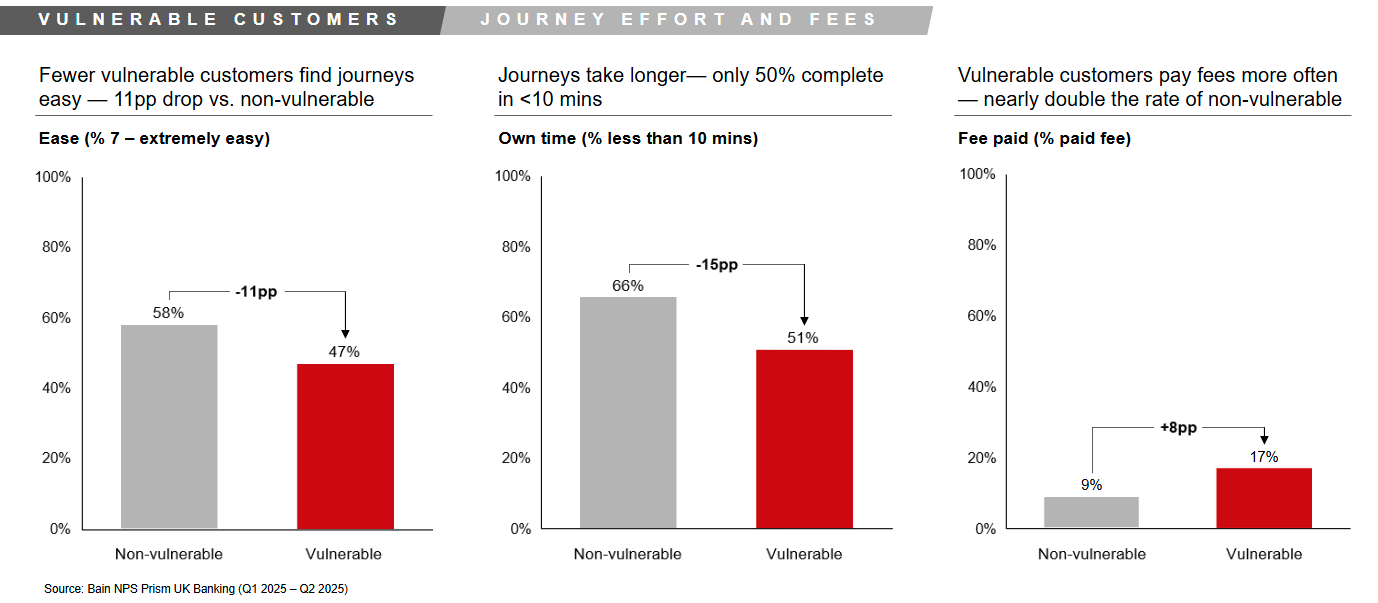

Where gaps emerge between vulnerable and non-vulnerable customers is in the effort and costs associated with completing customer journeys such as paying bills and withdrawing funds.

Vulnerable customers are finding journeys harder and longer to complete while also being more likely to incur fees. They are 11 percentage points less likely to rank a journey as “extremely easy” and 15 percentage points less likely to complete a journey in under 10 minutes. 17% report paying a fee during their journey, as opposed to only 9% of non-vulnerable customers. In aggregate, these solvable experience gaps may be bringing down vulnerable customers’ brand NPS and presenting unnecessary barriers to fully engaging this important group.

Simplifying processes, making channels easier to navigate, and increasing transparency and communication around fees are all steps that can be taken to improve journey-level scores for vulnerable customers, ultimately driving higher brand advocacy over time.

With vulnerability so widespread, designing processes with these customers in mind enables UK banks to better serve the true ‘average’ customer, protecting brand trust and boosting NPS across the board.

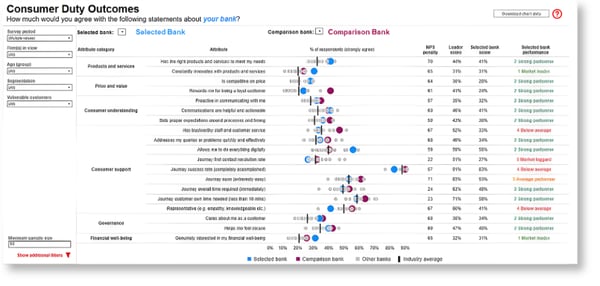

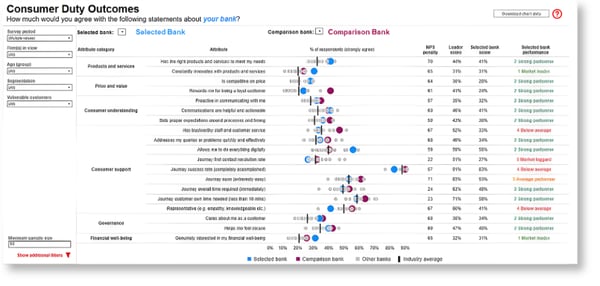

Want more insights on vulnerable customers and how to improve your customer journeys?

Schedule a personalized discovery session to explore our platform and gain never-before-seen NPS insights based on thousands of UK banking customers. You’ll be able to explore our new consumer duty dashboards and vulnerable customers filters that help you understand the optimal channel mix, communication approach, and best practices needed to improve CX for vulnerable customers.

*Source: Financial Conduct Authority